7 habits that are keeping you broke featured

Not planning your week financially

Have you ever started the week excited to maintain budgeting only to run out of money half way through? If that’s you, you need to start planning your week, and sticking with all the numbers you’ve sectioned off for each expense. Having a financial diet is crucial. It creates control over our finances, and changes our beliefs about what we can and can not be. Throughout the week, we get carried off by so many extra expenses, but we have to stay centered and only spend the money that we have told ourselves that we will; this is how you save money, and in the longer run, have money.

Overspending on food

Your week needs to be balanced. If you buy that five dollar latte, you need to make sure that lunch comes from home, a meal that you prepared, meaning you didn’t spend 10 dollars on it. Eating out all the time will burn a whole in your wallet, and may be one of the likely reasons you always end up with not enough money. Buying 40 dollars worth of grocery every week, that you can meal prep in the beginning of the week, will save you not only money, but also time, which you can spend working on another project that generates a better financial status. Repeating the same meal is key, not only for saving money, but also for maintaining weight. This will prevent binge eating, as you know exactly what you’re going to eat and when you’re going to eat it. The brain loves a set routine.

Impulse buying

Now a days, we find ourselves scrolling tiktok, instagram or watching youtube videos during our lunch breaks, or whenever we need to stimulate our minds. The pressure of trends lead us to the shops, for instant gratification, to feel better about ourselves and and to keep up appearances . At these moments, you have to remember the saying: Live like no one else will now, so you could live like no one else can later. Financial success takes sacrifice and discipline, and splurging all our money on overpriced products, without paying mind to our budget is a elementary action that can be prevented.

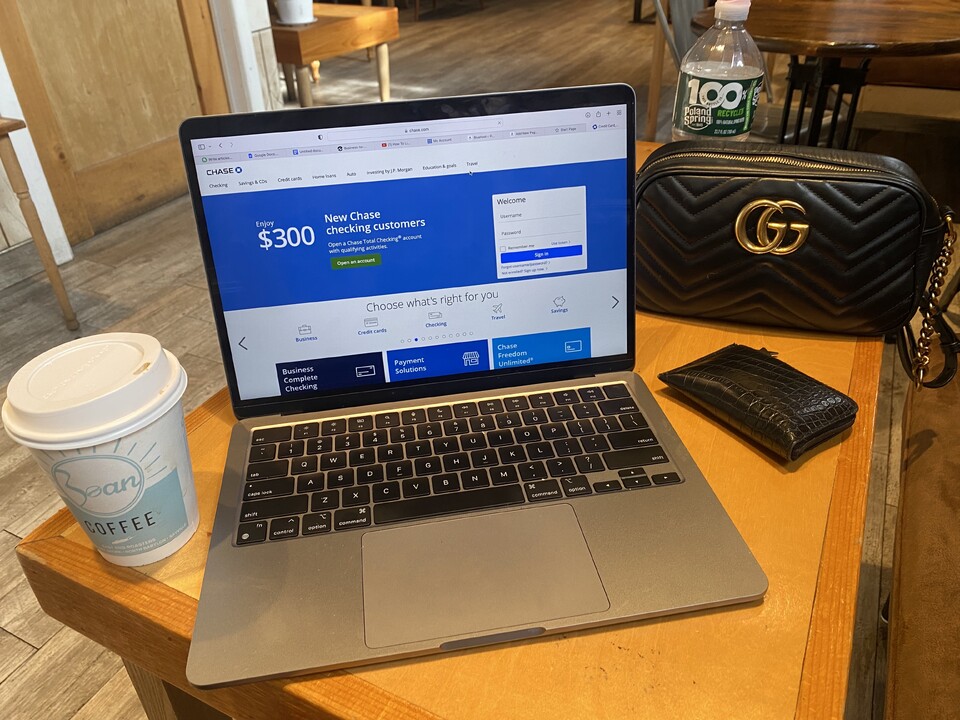

You use your credit card more than you should

If you spend more than you earn, that is a sure way to stay broke. You can’t live above your means and save money at the same time. This is why you need to plan your week financially, and not stray from it. You can tell yourself that you’ll pay it off once you get your next paycheck, but there are always new bills to pay and eventually they pile up. The best way to get out of debt is to get out of debt. This means that you stop using credit for purchase and instead use mostly the money that you have already, and not something that you don’t have.

No financial goals

Financial goals fuel our desire to have money. If we know exactly how much we need, and for what we need, we can easily treat saving/ budgeting money as a project. We can fantasize living in that new house, or not having debt anymore, or the feeling of pride because we were able to save ten thousand dollars for our emergency fund. Having direction with your money allows you to have a better perspective on your priorities, and life in general. Being directionless with anything leads to stagnancy and nowhere. Having a plan is key.

Not investing

Yes, you need to invest. I understand, you might think, hey, I don’t know how to invest, or investing is for those tech people, who know how to invest, or rich people. Let me change your mind, and tell you, it’s for you too. Money is for everyone, and increasing how much one has is for everyone too. There are so many ways that you can invest. Consider buying stocks, or opening a IRA. You can buy stocks using the money you put in the IRA and when the stock goes up, all the profits remain in that account. If you want to be able to live a great life even after retirement, you need to start building now. Great wealth requires a steady build. Years of saving and investing will eventually lead you to the life that you’ve always dreamt of.

Fear

If you come from a modest background, it can be hard to get out of that cycle of not having enough, and living paycheck to paycheck. The thought of being financially well-off can feel unsafe, because it isn’t familiar and normal. It is your duty to free yourself from the fear of failing. It’s your job to know that without taking risks, riches wont show up. You have to do the research, you have to develop yourself, and learn, unlearn and then re-learn until your money beliefs benefit you. Good money management isn’t something that needs to be ultra-time consuming. It is normal, and it can fit into your life, like the meals that you eat. Good money management, where you save, invest and budget is normal for so many and it can be normal for you as well.

Previous

Next

Comments are closed